Baltimore Car Accident Lawyers Ready To Fight for Fair Compensation

Baltimore’s bustling streets and historic charm come at a price: congested roads and distracted drivers. If you’ve recently been involved in a car accident in Charm City, you’re likely feeling overwhelmed and unsure of what to do next. You might be facing medical bills, lost wages, and property damage while trying to recover from your injuries.

That’s where Ashcraft & Gerel comes in. Our experienced car accident lawyers in Baltimore understand the unique challenges you face after a collision, whether it happened on the Jones Falls Expressway, I-95, or other dangerous areas, like the intersection of Gwynns Falls Parkway and Reisterstown Road.

Video Transcript

We’re dedicated to helping you seek the compensation you deserve to move forward with your life. Call our car accident lawyers in Baltimore, MD at 410-346-3983 for a free case review.

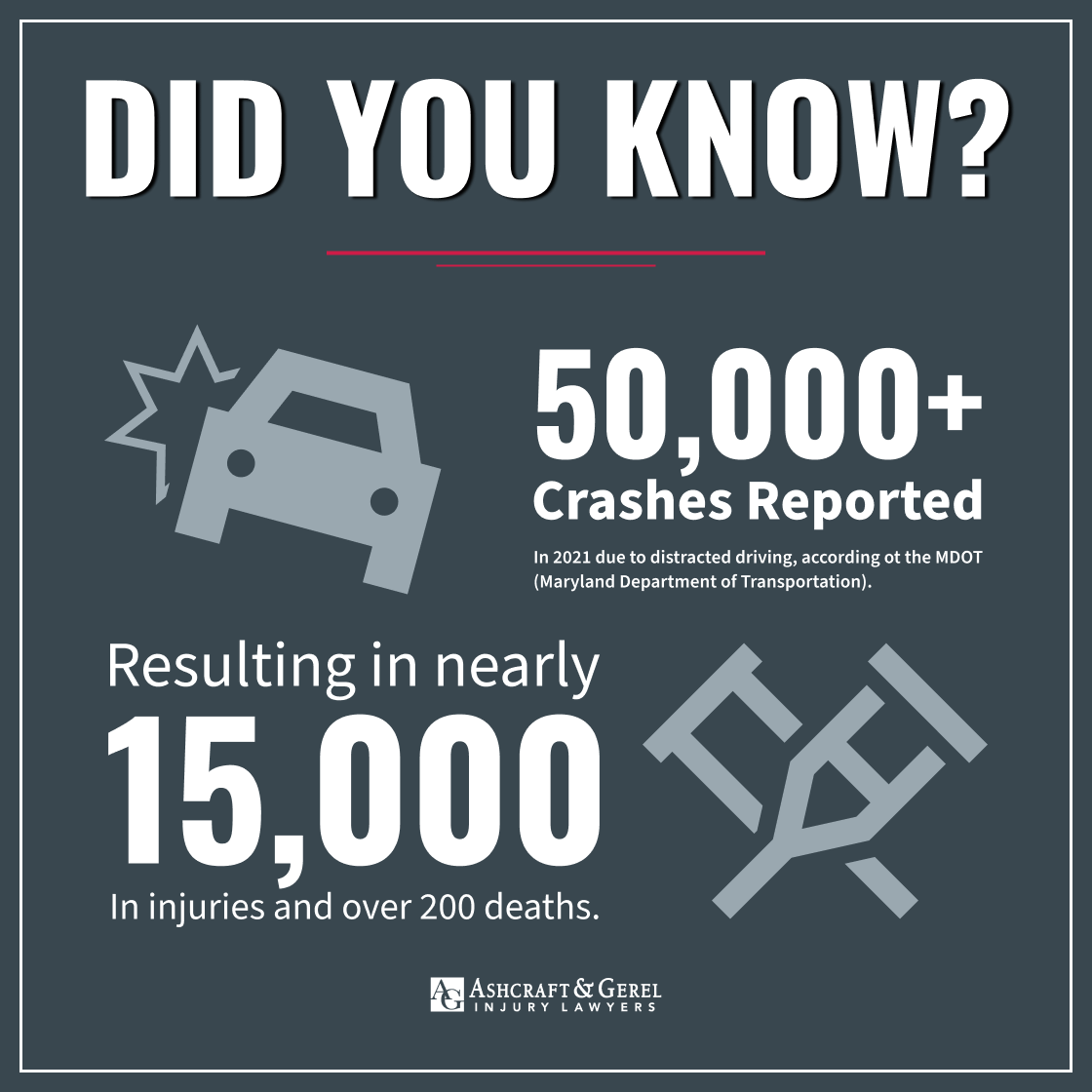

Curious about the scope of car accidents in Baltimore? Our infographic delves into the numbers, revealing key trends and areas of concern. Visualize:

- Accident frequency: How often do collisions occur in Charm City?

- Severity: What percentage of accidents result in injuries or fatalities?

- Common causes: What are the leading factors behind Baltimore’s crashes?

- Costly consequences: What’s the financial impact of car accidents in the city?

We encourage you not just to see the data, but to understand it. This infographic empowers you with insights to navigate Baltimore’s roads more safely.

Your Advocates for Justice

Since 1953, Ashcraft & Gerel has been a trusted name in Baltimore, helping accident victims secure the compensation they deserve. Our auto accident lawyers in Baltimore, MD have decades of experience navigating the nuances of Maryland car accident law, and our track record speaks volumes. With over $1 billion recovered for our clients, we’ve championed countless individuals through the complexities of legal claims.

But numbers only tell part of the story. We’re passionate about supporting our community and fighting for justice. We understand the emotional and financial toll car accidents can inflict, and we’re dedicated to guiding you through each step of the process with compassion and expertise.

Ready to learn more? Explore our page for insights into local accident trends, valuable resources, and contact information to schedule a free consultation. Together, let’s navigate the road to recovery.

Map and Directions

- Baltimore Location Hours: 24/7

RESULTS THAT MATTER

Steps to Take Immediately After a Car Accident in Baltimore

The moments following a car accident can be overwhelming. But amidst the chaos, taking the right steps can help safeguard your health, finances, and legal rights. Here’s what to prioritize:

- Check for Injuries & Secure the Scene: First and foremost, ensure everyone’s safety. If possible, move vehicles to a safe location and call 911 immediately. Always seek medical attention, even for seemingly minor injuries.

- Gather Information: Exchange contact and insurance details with all involved parties, including witness names and numbers if available. Document everything! Take photos/videos of the vehicles, license plates, damage, and the accident scene itself.

- File a Police Report: Request a police report from the Baltimore Police Department. This official document serves as crucial evidence for insurance claims and potential legal action.

- Seek Medical Evaluation: Don’t delay seeking medical attention, even if you feel fine. Some injuries, like whiplash, may not show symptoms immediately. A doctor’s evaluation is the best way to receive proper care and documentation.

- Connect with a Baltimore Car Accident Attorney: An experienced lawyer can navigate the legal complexities, protect your rights against insurance companies, and fight for the compensation you deserve. They understand Maryland car accident laws and can offer valuable guidance, even if you’re unsure about pursuing a claim.

These are just the beginning steps on your journey to just compensation. Having a trusted legal advocate by your side can make a significant difference in securing a fair outcome. Don’t hesitate to seek a free consultation with our Baltimore car accident injury lawyers to help make sure your rights are protected.

Baltimore, MD Police Department

Non-Emergency Phone: 311

Medical centers in/near Baltimore:

Common City Tow Yards

Main Impound Facility (by appointment only)

Monday–Friday 8:30 am – 5:00 pm

Saturday 9:00 am – 4:30 pm

Fallsway Facility

Monday–Friday 7:00 am – 7:30 pm

Closed Saturday, Sunday, and holidays (except for special events)

**Disclaimer: Ashcraft & Gerel does not endorse any of the above businesses, they are simply provided as resources to aid in getting you the support you need.

How Our Baltimore Car Accident Lawyers Can Help You

Many accidents in Baltimore are caused by someone’s negligence. When someone causes you or your family pain and suffering due to their actions (or inactions), and they have broken their duty of care, you may be entitled to compensation.

Maryland allows you to hold the negligent party responsible for your damages. That’s where our car accident lawyers in Baltimore can come to your aid. Our lawyers are able to significantly improve your chances of recovering damages in several ways:

- Maximize Compensation: They possess the expertise to assess your case’s full value, considering medical expenses, lost wages, pain and suffering, and potential future losses. They will help you seek the compensation you deserve.

- Expert Negotiation: Skilled lawyers have the experience and leverage to negotiate with insurance companies on your behalf. They understand the complexities of insurance law and can effectively advocate for a fair settlement offer.

- Case Management: From gathering evidence to handling complex legal procedures, a lawyer can manage every aspect of your case, allowing you to focus on healing and recovery.

- Protecting Your Rights: Lawyers understand the nuances of Baltimore car accident laws and can protect your rights throughout the legal process. They can help you avoid pitfalls and make informed decisions.

Types of Baltimore Car Accident Cases We Handle

For over 70 years, Ashcraft & Gerel has been a law firm committed to helping everyone who has suffered injuries and losses due to another’s negligence. Our expert Baltimore car wreck lawyers are capable of handling various types of car accident cases on your behalf, including:

- Fatal Car Accidents

- Head-On Collisions

- High-Speed Crashes

- Hit and Run

- Passenger Injuries

- Pedestrian Accidents

- Rear-end Accidents

- Rental Car Accidents

- Rideshare Accidents

- Rollover Accidents

- Diminished Value Claims

- Uninsured Motorist

- PIP

We have a wealth of experience and a proven track record of success in helping our clients secure the compensation they deserve.

Common Causes of Baltimore Car Accidents

Knowing the frequent causes of car accidents in Baltimore can help you stay vigilant and protect yourself on the road. Here’s a glimpse into the local data from the Maryland Department of Transportation (MDOT):

- Distracted driving: MDOT reported over 50,000 crashes in 2021 alone, resulting in nearly 15,000 injuries and over 200 deaths – a stark reminder of the dangers of inattentiveness.

- Speeding and aggressive driving: These risky behaviors contributed to over 11,000 crashes in 2021, causing nearly 3,500 injuries and 120 fatalities. Remember, exceeding the speed limit or driving aggressively significantly reduces reaction time and increases the risk of accidents.

- Driving under the influence: In 2021, over 6,500 car accidents were caused by impaired drivers, leading to roughly 2,000 injuries and 150 deaths. Never get behind the wheel under the influence of drugs or alcohol.

Roadwork: While crucial for maintaining road safety, construction zones like those on I-95, I-83 South, and I-495 can introduce congestion and unexpected lane changes, increasing the risk of accidents. You can check the Baltimore City Department of Transportation website for traffic advisories and active road closures before your trip.

Other Causes of Car Accidents

- Distracted Driving

- DUI Accidents

- Vehicle Defect

- Road Rage

- Drowsy Driving

- Police Chase

- Street Racing

- Tire Blowout

- Deadly Curves

- Sneezing

- Loose Objects

- Improper Turns

- Wrong Way Driver

- Unsafe Lane Changes

Common Car Accident Injuries

Car accidents can cause a wide range of physical and emotional injuries. Even if symptoms seem minor, seeking medical attention promptly after an accident is critical to your case. Early diagnosis and treatment can significantly improve recovery outcomes. While every situation is unique, some commonly reported injuries include:

- Whiplash, spinal cord injuries, and other back/neck injuries

- Head injuries, including traumatic brain injuries (TBI)

- Burns, cuts and lacerations

- Broken bones

- Internal organ damage or nerve injuries

- Mental and emotional suffering, including PTSD

- What Are Common Car Accident Injuries?

- What Is the Average Settlement for a Car Accident?

- How Long Does it Take To Settle a Car Accident Case?

- What Happens if You Don’t Have Auto Insurance?

- Who Pays My Medical Bills After a Car Accident?

- What Are the Types of Car Accidents?

- Who Is Liable in a Car Accident?

CLIENT TESTIMONIALS

Our Clients Come First. Always.

Our Baltimore Car Accident Attorneys Are Standing By

Experiencing a car accident in Baltimore can be confusing and stressful. This page has provided crucial information to help navigate the aftermath, understand common causes and injuries, and highlight the importance of legal representation.

Remember, Ashcraft & Gerel stands by your side throughout this challenging time. With over 70 years of experience and a proven track record of success, our Baltimore car accident lawyers possess the expertise and compassion to fight for the compensation you deserve.

Don’t wait – take control of your situation and seek the justice you deserve. Call our car accident lawyers in Baltimore, MD today at (410) 346-3983 or schedule a free case review online to discuss your options and get started on the road to recovery.

News and Updates

From The Ashcraft & Gerel Blog

Having a Black Car May Make Accidents More Likely

May 26, 2021

No one wants to get in a car accident, but if you think driving safely is enough to fend off collisions, think again. Almost every collision has multiple contributing factors. One such factor is car color. A number of studies conducted worldwide have found significant correlations between certain car colors and increased risk of accidents. …

View ArticleAttorney Alan Mensh Achieves Landmark Appeal Victory in Lead Poisoning Case

June 9, 2021

Attorney Alan J. Mensh, a senior partner at Ashcraft & Gerel, has achieved a game-changing appeal victory in a case (Ashley Hector, et al. v. Bank of New York Mellon) involving lead poisoning at a foreclosed rental property and two injured children. To date, he has written numerous legal briefs and delivered oral arguments in …

View ArticleAre Infotainment Systems Dangerously Distracting?

June 9, 2021

The primary purpose of an infotainment system is to act as a hub for the driver to access as much information as possible in one place, reducing driver distraction. With the radio, climate controls, navigation, phone contacts, and even the internet at the driver’s fingertips, auto designers hope to make these controls safer to use …

View Article